You likely have clients who are business owners. Also, with the rise of the gig economy, you may have even more who are 1099 contractors. Regardless, your business owners and 1099 contractors now have financial planning issues you can help them address.

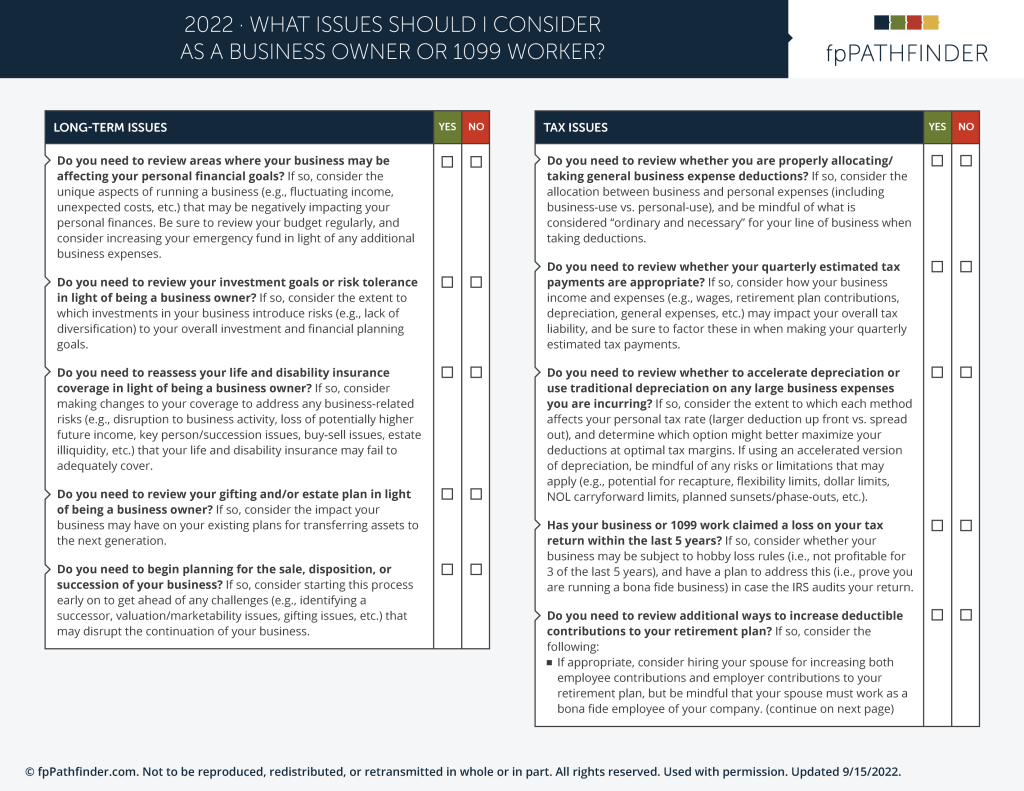

When engaging in financial planning with business owners and 1099 contractors, introduce the “What Issues Should I Consider As A Business Owner Or 1099 Worker?” checklist. The checklist will help uncover opportunities that may have gone unnoticed until it was too late.

The Business Owner And 1099 Contractor Checklist Provides Clarity

Being a business owner is more than office space and a good idea. There are several financial planning factors that the owner (your client) must account for when operating a business. The business owner checklist can raise awareness of critical issues your client should consider when making financial planning decisions. Specifically, the checklist will highlight:

- The effect running a business may have on the client’s personal financial goals.

- The general tax implications of running a business.

- How to coordinate specific tax planning issues (e.g., retirement plan contributions, certain deductions, hiring a spouse, and specific business entities) to better suit your client’s financial situation.

- Other areas that may be affected by operating a business, like risk tolerance, insurance needs, and financing issues.

Your Business Owner and 1099 Contractor Clients Will Thank You

With your guidance, your business owner and 1099 contractor clients will appreciate the complexities of owning a business. When you use the “What Issues Should I Consider As A Business Owner Or 1099 Worker?” checklist, you can raise awareness and uncover planning opportunities before they become problems. Additionally, you have a great tool to begin conversations on topics your client can explore further with your guidance.

fpPathfinder members can access more than 100 checklists and flowcharts in the Member Section on the website.

Not a member? We can help you with that. You can explore membership options on the Become A Member page. If you’d like a personal experience, register for a live demo! We would appreciate the opportunity to answer your questions.