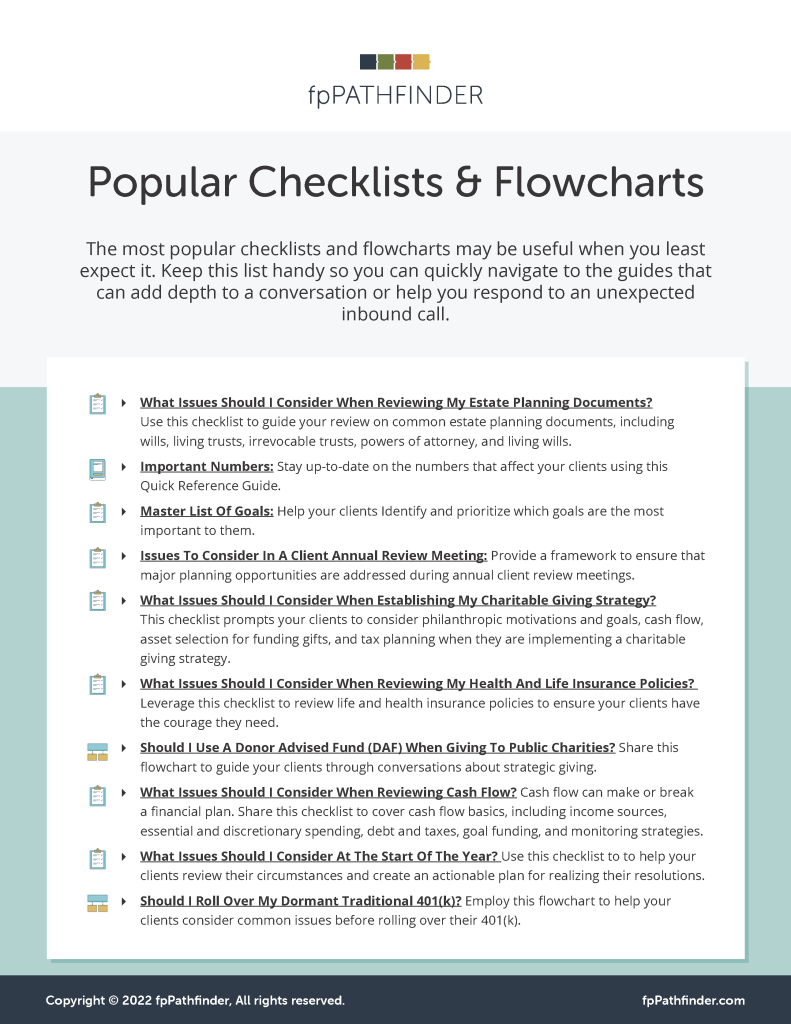

“Which guides are most popular among members?” Our team frequently hears this question. With nearly 100 different checklists, flowcharts, and reference guides, there are a lot of choices.

To give you quick access to often-used guides, we offer the Popular Checklists & Flowcharts list. The top 10 downloaded checklists, flowcharts, and summary guides are below. Download the PDF, including links to each guide, when you click on the list. We encourage you to keep it handy on your desktop so you can find what you need when you need it.