When the markets go down, the question of whether to implement a tax-loss harvesting strategy can come into play. Indeed, it’s tempting! The strategy can help the advisor “get something out of the decline” for clients. However, while tax-loss harvesting can be a good strategy, it’s not a slam dunk for every client.

If only there were a checklist to help you and your clients objectively decide yea-or-nay to implement the strategy.

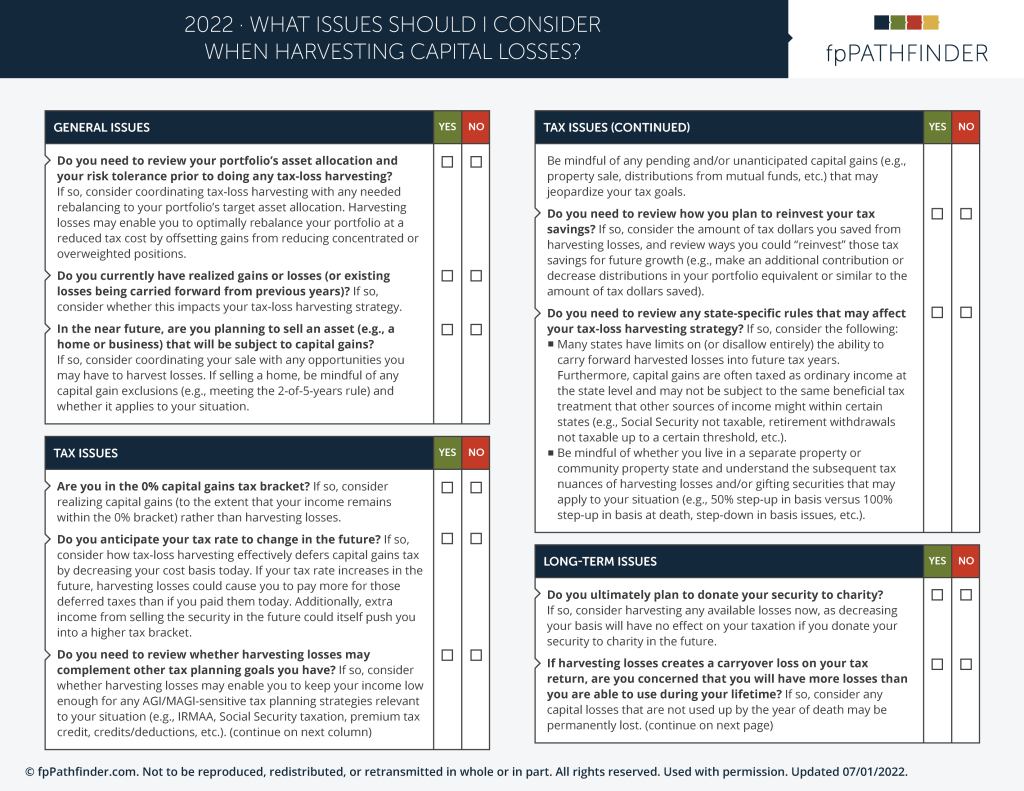

The Harvesting Losses Checklist

The good news is there is such a checklist! The “What Issues Should I Consider When Harvesting Capital Losses?” checklist is an ideal tool to share with clients. Your clients will appreciate that it covers concerns related to:

- The effect harvesting losses may have on portfolio goals.

- Common pitfalls and rules of which to be aware when harvesting losses.

- The potential tax benefits and consequences.

- The effect tax-loss harvesting can have on long-term goals.

When you want to address the topic with your clients, introducing the checklist can be a simple step in your client experience. Consider reaching out with an email message like this: You may hear a lot of talk about tax-loss harvesting while the markets are down. It can be an excellent strategy, but it’s not always the best choice for everyone. Before we decide about this strategy, please take a moment to complete this checklist, and then let’s talk. Your responses will help us determine the best next step.

Why This Checklist Matters

The “What Issues Should I Consider When Harvesting Capital Losses?” can help you establish transparency and trust in your client relationships. You’ll illustrate both sides — the positive and the negative — of the tax-loss harvesting equation. Ultimately, that means you have the opportunity to speak honestly and with authority on the topic as it relates specifically to the client. Additionally, when markets are down, you’ll differentiate yourself from other advisors who may feel like they need a talking point and “did something” during trying times.

A Gift

We worked with Ben Henry-Moreland as he wrote “Tax-Loss Harvesting Best Practices (And How To Scale It Across A Client Base)” for Kitces.com, Nerd’s Eye View, to create this advisor checklist. You can find it in the “Ensuring Correct Execution” section of Ben’s article, or you can click the image below and download it directly to your desktop. It will remain available for advisors to download indefinitely.

Are you curious to learn more about fpPathfinder’s 100+ checklists, flowcharts, and summary guides? If so, visit the Become A Member page or register to join a live 30-minute demo. We are here to answer your questions and show you how membership can support your practice.